Happy New Year to all subscribers, the CTG Team hopes you had a restful and happy end of year holiday. For those who have missed it, Bitcoin turned thirteen last Monday. Thirteen years ago, Satoshi Nakamoto mined the first Bitcoin block, with the following message encoded into the transaction:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

As we turn our attention to the markets, we can observe that the price of Bitcoin has remained relatively stagnant over the holiday season. As mentioned in our previous newsletters, there was a high probability that BTC will go test the lower part of the range we are currently in ($52,000-$40,000). We've seen it play out, and prices are currently hovering slightly above the lows of the range.

In this weeks newsletter, we'll look at some key on-chain metrics and zoom out to reflect where we were a year ago.

Technical Analysis

We have been experiencing high selling pressure for the past two month leading to increased fear, uncertainty and doubt in the market. We simply have not found enough new money to enter the market and make up for that selling. That money will come back once the price goes up long enough for people to think it will keep going up.

Some of you may think that this doesn’t feel like a bull market. The price has gone down for almost two months! Isn’t it supposed to go up only?

Look at the larger trend, big swings up and down, price rising higher each time:

Bull markets don’t always go straight up. They dip, correct and go back up again. Buy the dip and let everybody else push the market up for us.

In a few years—possibly a few weeks—bitcoin’s price will go above $66,000. Buy now so you won’t have to buy then, same applies for Altcoins.

It doesn’t always feel good, but most importantly having a plan forces us to buy when the price goes down and sell gradually when in profit.

On-Chain Data

As previously discussed in our newsletter the Active Address Sentiment Indicator is in an 'oversold' range, indicating that a price bounce is imminent. The chart below shows that each time the yellow line trended below the green one $BTC price bounces in the weeks following this occurrence, because price has retraced too much relatively to the network active address growth.

The on-chain metric below accounts for the percentage of circulating supply that has not moved in at least 1 year.

A higher percent points to long term holders’ accumulation, and a lower percent points to long term holders’ distribution.

We can see below that over the final months of 2021, even as prices corrected, there has been an uptick of this percent meaning that coins moved to increasingly illiquid wallets reflecting a higher likelihood of broader accumulation phase.

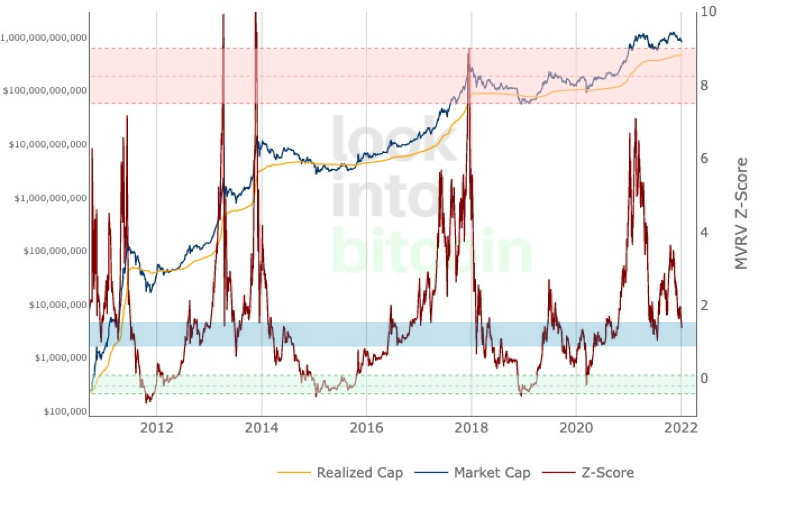

For the Short-Term Holder cohort, the MVRV metric shows the magnitude of current underwater pain relative to past bearish periods. The MVRV is currently trading in the highlighted blue zone below, an event that serves as a major level of support/resistance since the creation of Bitcoin.

Psychologically, this represents accumulation periods, where long term holders stack-up their sats. A bounce from this level would validate this theory.

CTG Coaching

As we put 2021 behind us, it's safe to say that it was one of the best years in cryptocurrency so far. We want each of you to reflect on what kind of progress you made last year and be honest with yourself, did you really give it your all? If you're having trouble getting where you want to go, make a weekly plan, write it down on a piece of paper, and look at it every day.

Anyone can be motivated for a day or a week, but it takes a true champion to be happy all year, no matter what life throws at them.

What makes you believe this year will be any different if you're going into 2022 with no action plan and just want to wing it?

Shout out to everyone who took full advantage of 2021, shout out to everyone who learned technical analysis, got involved in NFTs, built an investor mindset, and controlled their emotions navigating these volatile markets, etc.

We saw people make fun of us in 2017 for dumping our money into crypto and then in 2021 those same people were calling us lucky. We kindly ask them, why don't they create their own luck?

The one thing no one can ever take away from you is your education “Knowledge is power”. Never Stop Learning cause once you stop learning you start dying inside, always keep pushing & always take responsibility for your own mistakes.

Are you locked and loaded for 2022?